MY HUSBAND AND I SAVED FOR RETIREMENT — NOW OUR KIDS EXPECT US TO SHARE IT WITH THEM.

We spent decades budgeting, sacrificing small pleasures, and meticulously planning for our retirement, carefully nurturing our nest egg for the golden years we envisioned. Now that we're finally enjoying it – the freedom to travel to long-dreamed-of destinations, savoring leisurely dining experiences, and generally embracing a life unburdened by daily work – our adult kids are suddenly full of "suggestions" and increasingly pointed hints for how we should generously allocate our hard-earned money.

College tuition for the grandkids, a significant sum that would undoubtedly ease their children's financial burden. A substantial down payment on their first or perhaps their next house, a request that speaks to their aspirations for homeownership and stability. Even the daunting prospect of paying off their accumulated debt, a move that would provide them with immediate financial relief and a fresh start.

They often frame these requests with the seemingly benevolent phrase "helping family," appealing to our parental instincts and the ingrained desire to support our offspring. But if we diligently worked, made countless conscious choices, and endured years of financial discipline to afford this very lifestyle, a retirement we painstakingly built, why do we now have to grapple with feelings of guilt for simply enjoying the fruits of our labor and the financial independence we so diligently pursued? This is the reward we earned, the future we secured through years of careful planning.

This situation presents a deeply personal and, unfortunately, an increasingly common dilemma for many retirees. The natural transition from being the primary financial providers during their children's formative years to navigating their evolving financial needs as independent adults, all while steadfastly safeguarding our own long-term security and the enjoyment of our retirement, can be a complex and emotionally charged balancing act.

Our journey to this point was marked by deliberate choices. We, Sarah and I, understood the importance of delayed gratification, consistently prioritizing long-term financial health over immediate indulgences. Every budget we meticulously crafted, every small pleasure we consciously sacrificed, every strategic financial decision we made was with the clear vision of a comfortable and secure retirement in mind. This wasn't simply about accumulating wealth; it was about building a future where we could finally pursue our passions and enjoy the freedom we had so diligently earned.

Now, as we finally step into this long-awaited chapter, embracing the opportunities it presents – exploring new cultures through travel, indulging in the simple joy of a well-prepared meal without the constraints of a workday looming, and generally relishing a life where our time is truly our own – these requests from our adult children, while perhaps well-intentioned from their perspective, cast a shadow over our hard-won contentment.

Their perspective, while perhaps rooted in a genuine sense of need and a belief in familial support, likely overlooks the years of dedication and careful planning that underpin our current financial stability. They may view our retirement savings as a readily available resource, an extension of the support they received during their upbringing, without fully appreciating the finite nature of these funds and the potential future needs they are intended to address. The assumption that "family helps family" can be a powerful one, but it needs to be balanced with a realistic understanding of individual financial circumstances and responsibilities.

The feeling of guilt that gnaws at us is a familiar and potent emotion for parents. The ingrained desire to protect and provide for our children doesn't simply vanish when they reach adulthood. Witnessing them face financial challenges can trigger those deeply rooted protective instincts, making it difficult to prioritize our own needs. However, it's crucial to carefully differentiate between offering genuine support that empowers them and inadvertently enabling a pattern of dependency that could ultimately hinder their own financial growth and independence. Our retirement savings are not an inexhaustible well; they are meant to serve as a safety net and a source of security for our future, providing for potential healthcare costs, unforeseen emergencies, and the very lifestyle we have rightfully earned.

Open, honest, and potentially difficult conversations with our children, Michael and Jessica, are paramount. We need to clearly and calmly communicate the years of financial discipline and strategic planning that have led to our current situation, emphasizing that our retirement savings are specifically intended to ensure our own long-term security and well-being. We can express our unwavering love and genuine concern for their happiness and financial stability without automatically acceding to all of their substantial financial requests.

Consider exploring alternative avenues for "helping family" that don't directly involve depleting our carefully accumulated retirement funds. This could involve offering our experience and wisdom through advice and guidance on budgeting, career advancement, or perhaps even helping them connect with relevant resources. Smaller, one-time gifts for specific needs, if we feel genuinely comfortable and it doesn't compromise our own financial security, might also be an option. We could also suggest resources that could empower them to improve their own financial literacy and independence, such as recommending reputable financial advisors or educational materials on debt management and saving strategies.

Establishing clear and firm boundaries is absolutely essential. While we may choose to offer some level of support, it must be on our own terms, within a comfortable financial limit that doesn't jeopardize our future security, and without creating a precedent of expectation or entitlement. It is perfectly acceptable, and indeed responsible, to politely but firmly say "no" if their requests feel unreasonable in scope, create a sense of obligation and guilt, or ultimately threaten our own financial independence in our retirement years.

Ultimately, Sarah and I have earned the right to enjoy the retirement we worked so diligently and sacrificed so much to achieve, free from the burden of unwarranted guilt. Our decades of responsible financial planning should now afford us the peace of mind and the freedom to savor these golden years. While the desire to support our family remains a strong and natural one, it should not come at the expense of our own long-term security and well-being. Open communication, clearly defined boundaries, and a resolute understanding of our own priorities are the cornerstones to navigating this delicate and increasingly common family dynamic.

News in the same category

A weekend with grandma changed my son—but at what cost?

My Best Friend Stole My Husband—Ten Years Later, She Called Me Screaming His Darkest Secret

My fiancé and his mom demanded i wear a red wedding dress — but i had a better idea.

My MIL Demanded to Share a Hotel Room with My Husband During Our Anniversary Trip

My Parents Abandoned Me and My Younger Siblings When I Was 15 — Years Later They Knocked on My Door Smiling

It was late afternoon when 16-year-old Jake walked through the front door

School Principal Noticed 9-Year-Old Girl Was Taking Leftovers from the School Cafeteria Every Day and Decided to Follow Her

My MIL Sent Me a Huge Box for My Birthday – When I Opened It, Both My Husband and I Went Pale

Stay After Landing: The Pilot's Shocking News

5 Epic Stories of Entitled In-Laws Getting What They Deserved

My Son Asked If He Could Save a Seat for 'The Man Who Always Brings Mommy Flowers' at Thanksgiving

I Overheard My 9-Year-Old Daughter Whispering on the Phone: 'I'll Never Forgive Mom for What She Did'

My Dad Kicked Me Out for Marrying a Poor Man – He Cried When He Saw Me After 3 Years

My Parents Stole My College Money for My Brother's Wedding, Their House, and Business – but They Messed with the Wrong Person

My Husband Left Me and the Kids at Home on X-Mas Eve and Went to Celebrate at His Office Party – We Paid Him a Visit There

Our House Was Egged on Christmas — I Was Flabbergasted When I Found Out Who Did It

My Mother's Death Put Me in a Courtroom and a Home That Isn't Mine

I Yelled 'I Don’t!' at My Own Wedding after Conversation with Groom’s Mother Whose Plan Almost Worked Out

My Ex Ruined My First Day at Work, I Brilliantly Took Revenge on Him the Same Day

News Post

Merck Was Injecting Girls With Aluminum But Told Them It Was A Saline Placebo: This Is Why It's Called "Big Pharma"

Expert Unveils the Four 'Worst' Drinks for Your Heart and Why You Should Steer Clear

Cloves, Ginger, and Lipton Tea: A Health-Boosting Trio

5 Early Signs of Liver Damage You Should Look Out For

Man diagnosed with cancer months after doctors dismissed symptoms and said he was ‘too young’

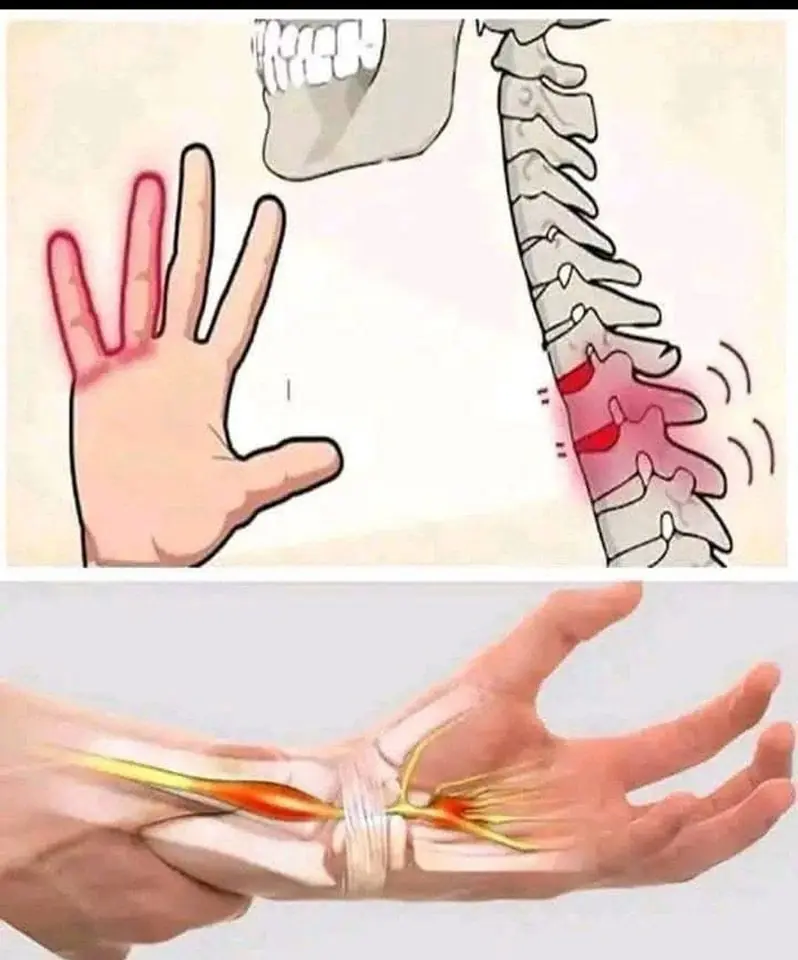

Tingling Sensation In Your Body: Why Does It Happen

Why Do Some People Remember Their Dreams More Than Others?

Police release statement after autistic teen left fighting for life after being shot '9 times' by cops

Risk Of Prostate Cancer Increases By 45% In Men Who Share This Common Practice

Better Than Aspirin! Ginger Tea Prevents Clots Naturally

Scientists Rejuvenate Skin Of 53-Year-Old Woman To That Of 23-Year-Old In Groundbreaking Experiment

Experts claim there's a 'golden hour' for when you should sleep that could make you live longer

Start Your Day Right: The 10 Incredible Benefits of Drinking Olive Oil Every Morning

My Dad Said Something Before He Took His Last Breath—And I Can’t Shake It

A weekend with grandma changed my son—but at what cost?

My Best Friend Stole My Husband—Ten Years Later, She Called Me Screaming His Darkest Secret

My fiancé and his mom demanded i wear a red wedding dress — but i had a better idea.

My MIL Demanded to Share a Hotel Room with My Husband During Our Anniversary Trip

My Parents Abandoned Me and My Younger Siblings When I Was 15 — Years Later They Knocked on My Door Smiling